are dental implants tax deductible in canada

Is cataract surgery tax-deductible in Canada. If you are 65 or over they are deductible to the extent they exceed 75 Please click here for more information.

12 Easy Ways To Get Affordable Dental Implants In 2022 Authority Dental

Preventive treatment includes the services of a dental hygienist or.

. The only exception is dental work that is purely cosmetic such as teeth whitening. Augmentations such as chin cheek lips. In an effort to assist in the dental expenses you incur the Canada Revenue Agency makes them deductible on your tax return.

Dental expenses includes fillings dentures dental implants and other dental work that is not covered by your insurance plan. What dental expenses are tax deductible in Canada. You were 18 years of age or older at the end of 2021.

Even if you have insurance coverage that includes implant treatment you could still receive a tax credit. Dental implants are tax deductible so thats good news. Body modifications such as tongue splits.

Medical costs deduction in Canada since 2010 have not allowed for cosmetic procedures. In order to help you with this cost the Canada Revenue Agency allows you to deduct dental expenses from your income tax when filing. The scope of the cost of dental expenses is broad including fillings dentures dental implants and.

The costs of treatment may be refunded up to 25 by counting on your annual income and other medical expenses. Dental expenses will generally be deducted as medical expenses on your Canadian income tax forms among other things. There is a small catch though.

Other dental work even if it is covered in your policy is not paid for. Most dental expenses can be used as medical expense deductions when filing your income taxes in Canada including. That 20 is the portion you can.

Payments of fees to doctors dentists surgeons chiropractors psychiatrists psychologists and nontraditional medical practitioners. The good news is yes dental implants are tax deductible. Dental expenses includes fillings dentures dental implants and other dental work that is not covered by your insurance plan.

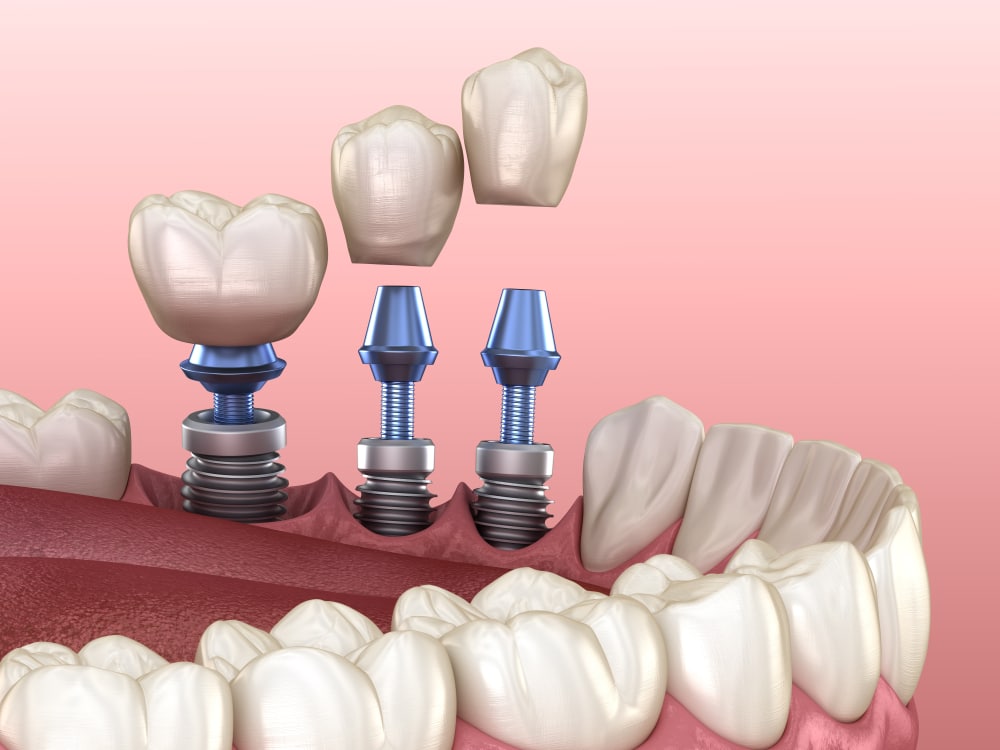

Yes Dental Implants are Tax Deducible. The CRA had provided examples of expenses incurred for purely aesthetic purposes that will generally be ineligible for the Medical Expense Tax Credit METC. Vancouver dentists british columbia bc canada A dental implant is an artificial tooth root that is anchored in your jaw to hold a replacement tooth.

In order to help you with this cost the Canada Revenue Agency allows you to deduct dental expenses from your income tax when filing. You can include in medical expenses the amounts you pay for the prevention and alleviation of dental disease. The good news is that will include all of your medical and dental expenses not just your dental implants.

In order to help you with this cost the Canada Revenue Agency allows you to deduct dental expenses from your income tax when filing. In addition to fillings dentures dental implants and other dental work that is not covered by your insurance plan dental expenses also include other dental work. In addition to fillings dentures dental implants and other dental work that is not covered by your insurance plan dental expenses also include other dental work.

If your employer offers a Health Savings Account HSA this could help you with costs associated with the surgery. The only dental work that is not covered is cosmetic work such as teeth whitening which is not. Per the IRS Deductible medical expenses may include but arent limited to the following.

The deduction is not automatically deducted however so you will need to itemize your deductions in order to claim it. It also explains Medical care expenses include payments for the diagnosis cure mitigation treatment or prevention of. Can I use this as a deduction.

In order to help you with this cost the Canada Revenue Agency allows you to deduct dental expenses from your income tax when filing. This goes for dental costs and all other medical costs whether you see a dentist or specialist. For example if your insurance covers 80 of the cost of treatment for denture implants or dental implants you are responsible for paying the remaining 20.

You were resident in Canada throughout 2021. Yes dental implants are an approved medical expense that can be deducted on your return. In addition to fillings dentures dental implants and other dental work that is not covered by your insurance plan dental expenses also include other dental work.

To help you with this cost the Canada Revenue Agency allows dental expenses to be used as medical expense deductions when you file your income tax. These items are as follows. Medical expense deductions for dental costs may also be made available in your taxable income by the Canada Revenue Agency.

If dental expenses can be credited to your personal income tax the Canada Revenue Agency allows tax payers to make these credits during the year. Is the cost tax-deductible. You should speak with.

You would have to eat the first 3000 of those expenses before it starts lowering your tax obligation. To help you with this cost the Canada Revenue Agency allows dental expenses to be used as medical expense deductions when you file your income tax. Medical expenses are an itemized deduction on Schedule A and are deductible to the extent they exceed 10 of your adjusted gross income AGI.

Lets say you make 40K a year. In addition to fillings dentures dental implants and other dental work that is not covered by your insurance plan dental expenses also include other dental work. Despite the pain of dental implants they hold up well.

While dental implants arent specifically mentioned in IRS Publication 502 the IRS says. You can only deduct expenses greater than 75 of your income. You made a claim for medical expenses on line 33200 of your tax return Step 5 Federal tax or for the disability supports deduction on line 21500 of your tax return.

I paid 800000 for dental implants. Laser eye surgery is a tax-deductible medical. Most dental work such as fillings dentures dental implants and others arent covered by your health insurance.

Other dental work not paid by your insurance plan. Yes dental implants qualify as a tax-deductible medical expense under current Revenue Canada guidelines. You can claim the portion of the procedure that you pay also known as the co-pay.

Your household does not have insurance that provides reimbursement for the use of dentures or dental implants you can use that information on your tax return to claim up to 5000 for these procedures. You must also meet the criteria related to income. You cannot make use of your insurance plan to pay for dental expenses not covered likefillings dentures dental implants.

Are Dental Implants Tax Deductible In Canada. Can I Claim Dental Implants On My Taxes In Canada.

What Percentage Of Dental Expenses Are Tax Deductible In Canada Ictsd Org

Dental Implant Cost Near Me Clear Choice Cost Maryland

London S Full Denture Service Clinc Professional Onsite Lab

Dental Terminology By Phillip Ravenclaw Issuu

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

Are Dental Bills Tax Deductible In Canada Ictsd Org

Are Dental Crowns Tax Deductible In Canada Ictsd Org

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

Can I Claim Dental Implants On My Taxes In Canada Ictsd Org

Are Dental Implants Tax Deductible In Canada Ictsd Org

Cheap Foreign Dental Care Attracting More Quebecers Says Order Of Dentists Cbc News

Is Dental Care Tax Deductible In Canada Ictsd Org

Are Dental Costs Tax Deductible In Canada Cubetoronto Com

Dental Implant Cost Dental Implants Start From 900

How Much Do Dental Implants Cost In Canada Explained Groupenroll Ca

Dental Bridge Cost Villa Park Il How Much Are Teeth Bridges 2021 Handcrafted Smiles